Does Flat Fee Include Tax . Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Examples of a flat tax include the sales tax and social security and medicare taxes. Employing a flat tax means that taxpayers cannot take deductions or. Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Web a flat tax levies the same fixed percentage rate on all taxpayers. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Many people argue that it is a fair.

from efiletaxonline.com

Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Many people argue that it is a fair. Employing a flat tax means that taxpayers cannot take deductions or. Examples of a flat tax include the sales tax and social security and medicare taxes. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web a flat tax levies the same fixed percentage rate on all taxpayers.

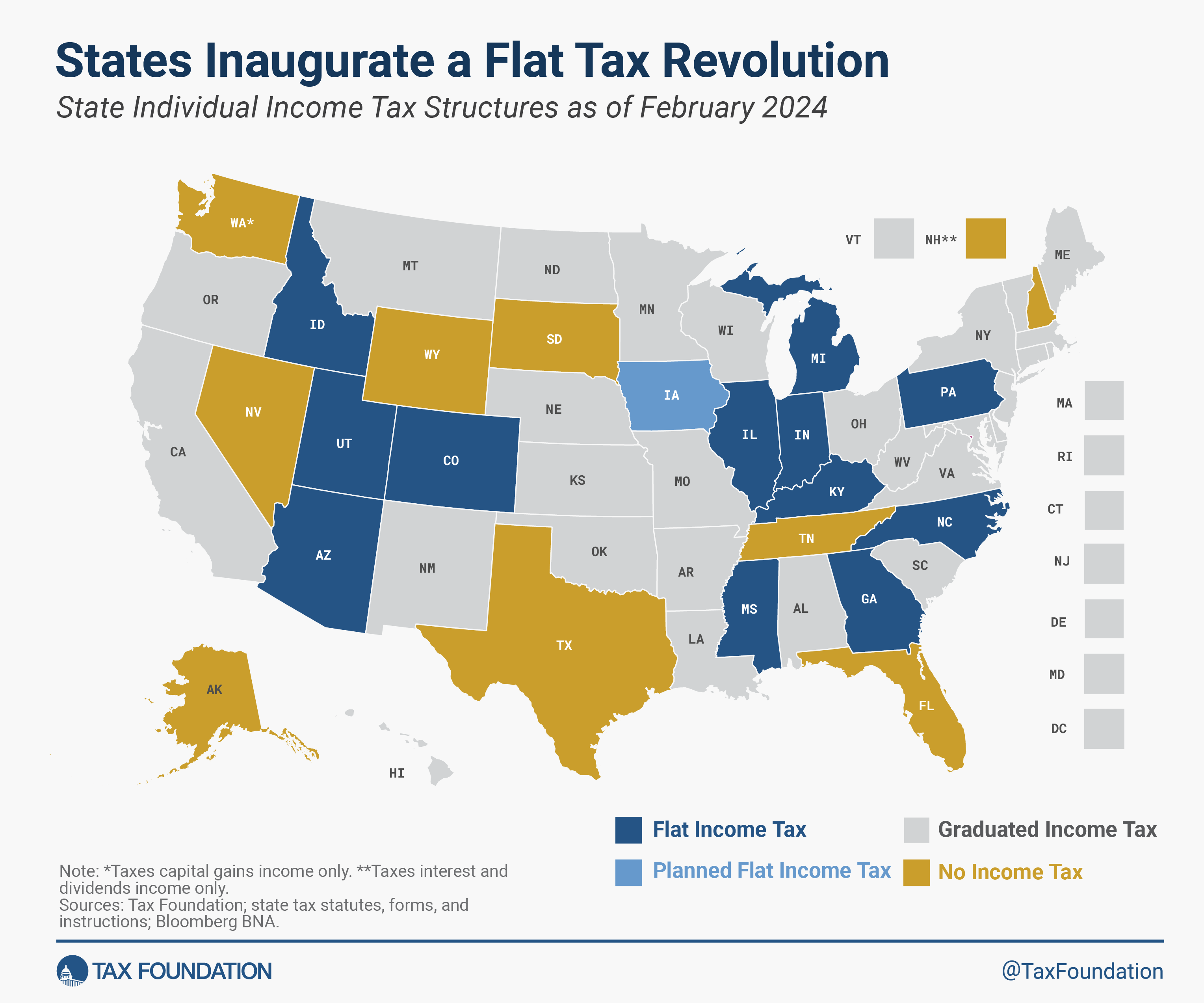

Flat Tax Revolution State Tax Reform

Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Employing a flat tax means that taxpayers cannot take deductions or. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Examples of a flat tax include the sales tax and social security and medicare taxes. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web a flat tax levies the same fixed percentage rate on all taxpayers. Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Many people argue that it is a fair.

From www.pdsplanning.com

5 Things To Know About Financial Adviser Fees PDS Planning Blog Does Flat Fee Include Tax Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Employing a flat tax. Does Flat Fee Include Tax.

From azflatfee.com

AZ Flat Fee Full Service Flat Fee vs Traditional Real Estate Does Flat Fee Include Tax Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Employing a flat tax means that taxpayers cannot take deductions or. Web a flat tax levies the same fixed percentage rate on all taxpayers. Examples of a flat tax include the sales tax and social security and medicare taxes. Web [formula]. Does Flat Fee Include Tax.

From get.flatfeetaxservices.com

Flat Fee Tax Software includes everything you need to succeed and grow Does Flat Fee Include Tax Web a flat tax levies the same fixed percentage rate on all taxpayers. Examples of a flat tax include the sales tax and social security and medicare taxes. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web a. Does Flat Fee Include Tax.

From www.realestatewitch.com

Flat Fee Group Reviews What You NEED to Know Does Flat Fee Include Tax Many people argue that it is a fair. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web while economists would describe a. Does Flat Fee Include Tax.

From www.texasroadrunnerrealty.com

Flat Fee Real Estate Listing Texas Roadrunner Realty Does Flat Fee Include Tax Web a flat tax levies the same fixed percentage rate on all taxpayers. Employing a flat tax means that taxpayers cannot take deductions or. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you. Does Flat Fee Include Tax.

From www.hauseit.com

What Is a Flat Fee MLS Listing? Does Flat Fee Include Tax Web a flat tax levies the same fixed percentage rate on all taxpayers. Many people argue that it is a fair. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Employing a flat tax means that taxpayers cannot take deductions or. Web [formula] flat rate price = (hourly rate * hours of work). Does Flat Fee Include Tax.

From www.youtube.com

Flat Fee vs Percentage What Management Fee Structure is Best? YouTube Does Flat Fee Include Tax Many people argue that it is a fair. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Examples of a. Does Flat Fee Include Tax.

From www.pdffiller.com

Sample FlatFee Agreement Doc Template pdfFiller Does Flat Fee Include Tax Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Web a flat tax levies the same fixed percentage rate on all taxpayers. Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Examples of. Does Flat Fee Include Tax.

From birchwoodcapital.com

FlatFee Financial Advisor Our Fee Structure Birchwood Capital Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Web a flat tax is a single tax rate applied to. Does Flat Fee Include Tax.

From ohiomlsflatfee.com

Ohio Flat Fee MLS Listing Ohio Flat Fee MLS For Sale By Owner Does Flat Fee Include Tax Many people argue that it is a fair. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Employing a flat tax means that taxpayers cannot take deductions or. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things. Does Flat Fee Include Tax.

From www.canopytax.com

How to Price Your Tax Resolution Services Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Examples of a flat. Does Flat Fee Include Tax.

From efiletaxonline.com

Flat Tax Revolution State Tax Reform Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Employing a flat tax means that taxpayers cannot take deductions or. Web a flat. Does Flat Fee Include Tax.

From caretlegal.com

When to Use Flat Fee vs. Hourly Billing at Your Firm CARET Legal Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Web a flat tax. Does Flat Fee Include Tax.

From flatfeehouses.com

Upgrade Listing Flat Fee Houses Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Web a flat tax levies the same fixed percentage rate on all taxpayers. Examples of a flat tax include the sales tax and social security and medicare taxes. Many people. Does Flat Fee Include Tax.

From www.listnowrealty.com

The Ultimate Guide To Flat Fee MLS Listings In Florida List Now Realty Does Flat Fee Include Tax Employing a flat tax means that taxpayers cannot take deductions or. Web a flat tax is a single tax rate applied to all taxpayers regardless of income. Web a flat tax levies the same fixed percentage rate on all taxpayers. Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Examples. Does Flat Fee Include Tax.

From www.zazoom.it

Flat tax per le partite IVA come funziona e tutto quello che c’è da Does Flat Fee Include Tax Web a flat income tax system is one where everyone is taxed at the same rate, no matter how much money they earn throughout the year. Examples of a flat tax include the sales tax and social security and medicare taxes. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if. Does Flat Fee Include Tax.

From support.compliancepublishing.com

What are the flat fee types? Does Flat Fee Include Tax Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Employing a flat tax means that taxpayers cannot take deductions or. Many people argue that it is a fair. Web a flat income tax system is one where everyone is. Does Flat Fee Include Tax.

From studylib.net

minimum fee schedule for tax services Does Flat Fee Include Tax Web while economists would describe a perfectly flat income tax as one that does not distinguish between types of. Web [formula] flat rate price = (hourly rate * hours of work) + (materials cost * markup percentage) if you price things correctly, a flat rate will cover the direct. Employing a flat tax means that taxpayers cannot take deductions or.. Does Flat Fee Include Tax.